POS - Analytics: Tax Summary

Tax Summary Analytics

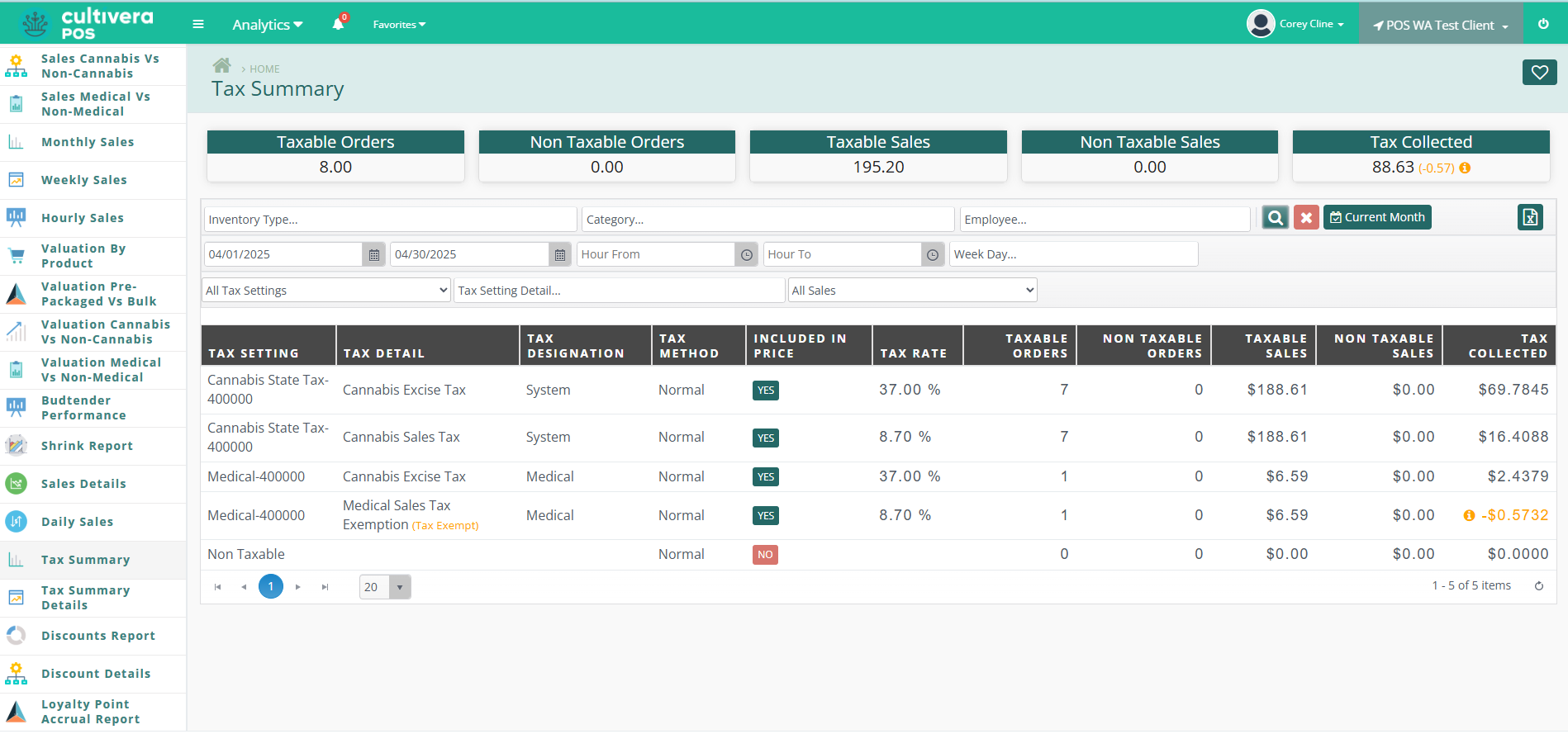

The Tax Summary Analytic in Cultivera Point of Sale’s Back Office is a powerful reporting tool used to review Taxable Net Sales, Tax Collected, and Tax-Exempted Amounts across different types of transactions. The report is especially useful for preparing tax filing documentation by giving a complete overview of your store’s sales and excise tax activity across both cannabis and non-cannabis products.

What This Report Shows:

The analytic pulls detailed tax data from all completed transactions within a selected time frame. It presents a clear breakdown of:

- Taxable Orders (Number of completed orders that included taxable items)

- Non-Taxable Orders (Number of completed orders where products were designated tax-exempt)

- Taxable Sales Amount (Total dollar value of items sold that were subject to tax - also known as Net Sales)

- Non-Taxable Sales Amount (Total dollar value of products sold that are designated fully tax-exempt)

- Taxes Collected (The actual amount of tax charged to customers and collected by the retailer during the reporting period)

- Taxes Exempted (The total value of tax that would have been charged but was not, due to exemptions such as medical patient status or special designations)

Each entry is grouped by the Tax Setting, with detailed tax designations such as System Default, Medical Exemptions, or other Custom Tax applications (Ex: Disabled Veteran or Tribal Citizen), all set up and configured during your onboarding process.

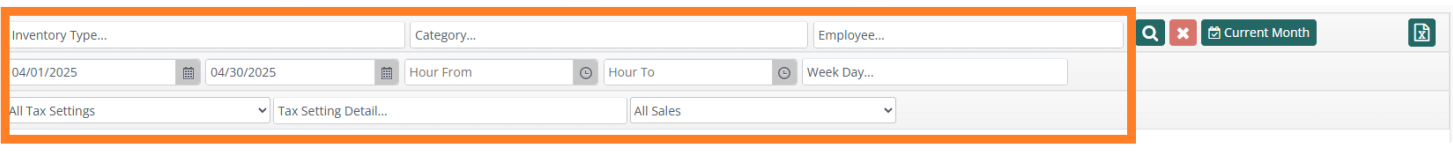

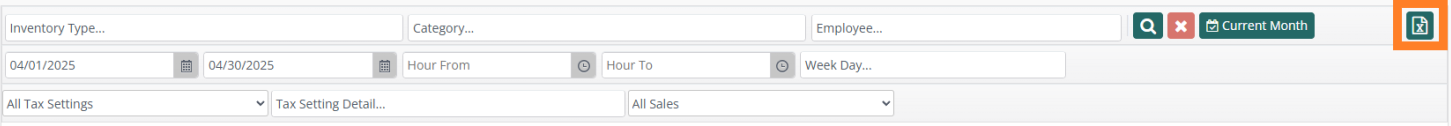

Users can refine report results using the following filters:

- Inventory Type

- Category

- Employee

- Date & Time Range

- Days of the Week

- Tax Setting

- Tax Detail

These filters help isolate tax behavior across specific types of sales, employee shifts, or inventory types and categories.

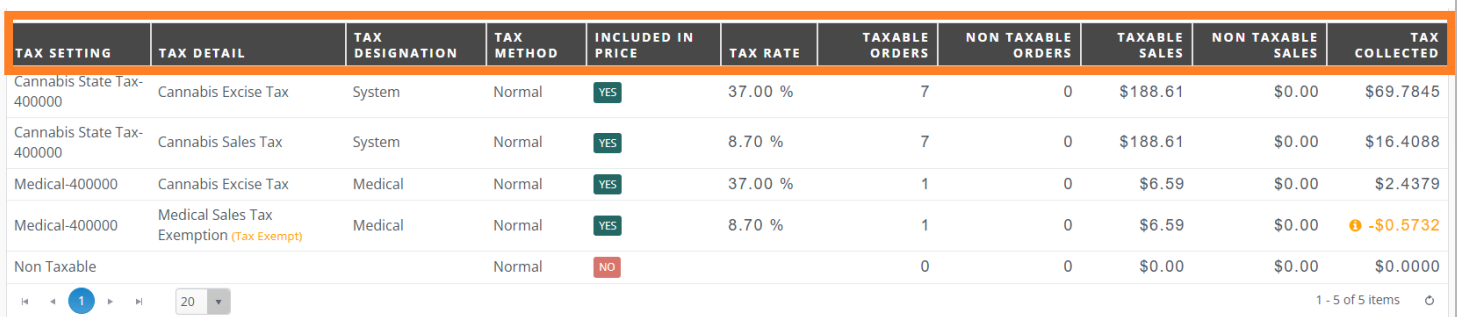

The displayed table includes the following fields:

- Tax Setting

- Tax Detail (Ex: Cannabis Excise Tax, Cannabis Sales Tax, Medical Excise Tax, Medical Sales Tax, DOH Medical Excise Tax, DOH Medical Sales Tax, etc.)

- Tax Designation (Ex: System, Medical, and DOH)

- Tax Method

- Included in Price (Yes = Out the Door pricing / No = Tax calculated at the register)

- Tax Rate

- Taxable Order Total

- Non-Taxable Order Total

- Taxable Sales Amount

- Non-Taxable Sales Amount

- Taxes Collected

- Taxes Exempted

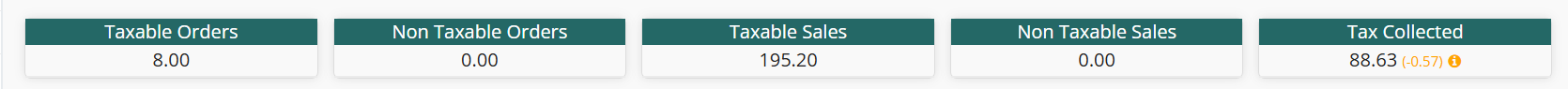

At the top of the report, grand totals for each of these categories are displayed for quick reference:

- Taxable Orders

- Non-Taxable Orders

- Taxable Sales

- Non-Taxable Sales

- Tax Collected

- Tax Exempted (Shown in gold)

The full report can be exported to Excel, enabling users to:

- Organize data for external reports or spreadsheets

- Share with finance teams or auditors

- Retain copies for tax filing documentation

Typical Use Cases:

Monthly or Weekly Filing Prep

- A common workflow is selecting the previous month or week in the date range filter to view your Net Taxable Sales and total Tax Collected and Exempted for submission to your accountant.

Designation-Based Review

- Review how much tax was collected or exempted under each Tax Designation (Ex - System, Medical, or DOH).

Finding total Taxable Sales, Taxes Collected, and Taxes Exempted

Let’s walk through how to use the Tax Summary Analytic to calculate your total taxable cannabis sales and total taxes collected for a reporting period.

Step-by-Step Example:

Imagine your store uses the following Tax Designations:

- Cannabis System (Standard Recreational Sales)

- Medical Patient (Sales Tax Exemption for qualifying patients)

- DOH Medical Cannabis (Fully tax-exempt for qualifying patients and inventory)

Each Cannabis Tax Setting typically includes two Tax Details:

- One for Excise Tax

- One for Sales Tax

To Find Total Taxable Sales for Cannabis Products:

- Locate each Tax Setting related to cannabis sales:

- Example: “Cannabis System,” “Medical Cannabis,” and “DOH Medical Cannabis”

- For each setting, find the Taxable Sales Amount (you’ll see it listed for both tax details).

Only add each setting’s Taxable Sales Amount once, even though it appears twice:

Example:

- Cannabis System: $12,000 (appears twice - only count once)

- Medical Cannabis: $5,000 (appears twice - only count once)

- DOH Medical Cannabis: $3,000 (appears twice - only count once)

- Total Taxable Sales = $20,000

To Find Total Sales Tax Collected:

Still using the same Tax Settings, find the Sales Taxes Collected for each Tax Detail.

Add up all Sales Taxes Collected values:

- Cannabis System Sales Tax Collected: $1,200

- Medical Cannabis Sales Tax Collected: $0 (Exempted amounts will be shown in gold, but are excluded from totals collected)

- DOH Medical Sales Tax: $0 (Exempted amounts will be shown in gold, but are excluded from totals collected)

Total Tax Collected = $1,200

To Find Total Excise Tax Collected:

Still using the same Tax Settings, find the Excise Taxes Collected for each Tax Detail.

Add up all Excise Taxes Collected values:

- Cannabis System Excise Tax Collected: $3,000

- Medical Cannabis Excise Tax Collected: $1,000

- DOH Medical Cannabis Excise Tax Collected: $0 (Exempted amounts will be shown in gold, but are excluded from totals collected)

Total Tax Collected = $4,000

Summary:

- Taxable Sales Amounts should only be counted once per Tax Setting.

- Taxes Collected can be summed from all applicable Tax Details.

- This approach gives you totals for Net Taxable Sales and Total Tax Collected, which can then be used for accounting purposes.